(FWA 2025/11/28)This Guide for Expats Claiming Labor Insurance Old-Age Benefits applies to all expats who have worked in Taiwan and participated in Labor Insurance (including blue-collar migrant workers, white-collar professionals, and foreign spouses). When you reach the statutory eligible age, don’t forget the rights and benefits you accumulated in Taiwan!

I. Core Regulation: Are you “New System” or “Old System”?

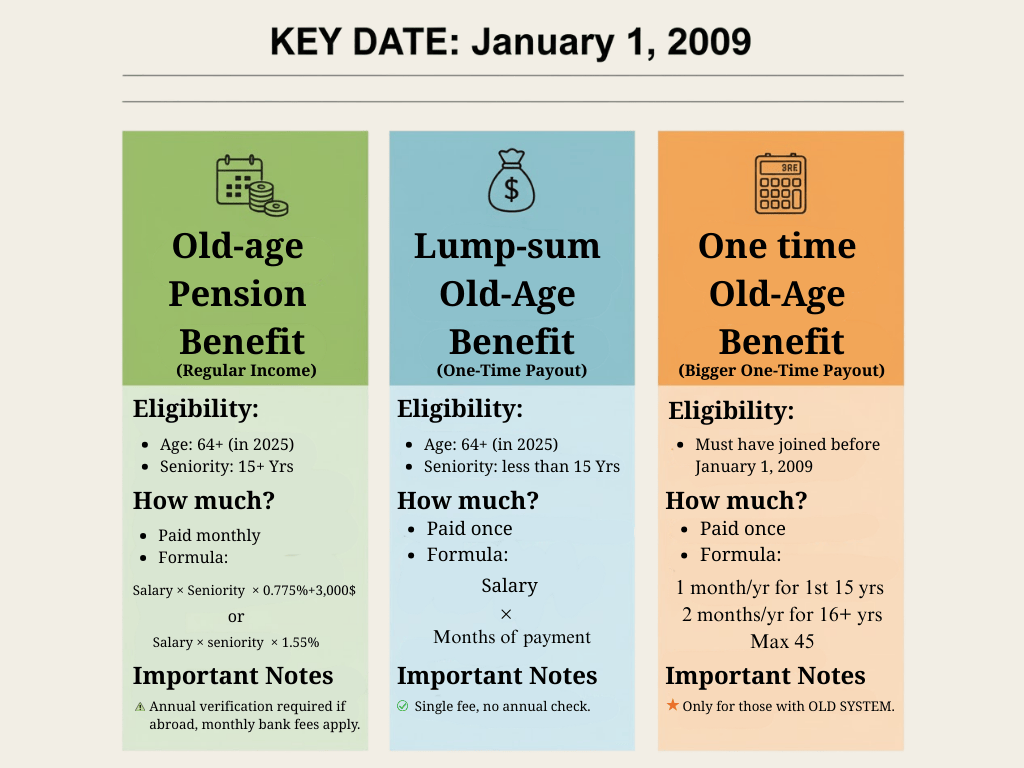

Which benefits expats can choose depends on one key date: January 1, 2009.

Key Watershed: If you had already participated in Taiwan’s Labor Insurance before this date, you possess the right to choose the “Old System Lump-Sum Payment”.

Mandatory New System: If you participated in Taiwan’s Labor Insurance for the first time after this date, you can only apply under the New System (Annuity or Lump-Sum) and cannot choose the Old System.

II. 2025 Standard: Full Age 64

The statutory age for claiming Labor Insurance Old-Age Benefits is gradually increasing. For 2025, the claiming age is 64 years old (calculated by actual date of birth).

| Benefit Type | 2025 Eligibility | Payment Method | Notes |

| 1. Old-Age Annuity Benefit (Monthly) | • Full Age 64 • Seniority: 15+ Years | Remitted monthly. | Paid for life. Overseas collection is more complex (requires annual verification). |

| 2. Old-Age Lump-Sum Benefit (One-time) | • Full Age 64 • Seniority: < 15 Years | Paid once. | Suitable for shorter seniority. 1 month’s salary for every year of seniority. |

| 3. Lump-Sum Old-Age Payment (Old System) | • Full Age 64 • Key: Must have seniority BEFORE Jan 1, 2009 | Paid once. | Choice for most senior expats. Better calculation: 1 month/year for first 15 yrs; 2 months/year after. Max 45 months. |

III. How to Apply from Abroad? (Important Steps)

If expats are no longer in Taiwan when they become eligible, please follow these steps:

Step 1: Prepare Documents and Power of Attorney

Since you are absent, entrust someone (e.g., former employer, agency, friend) to apply. Fill out the application and draft a “Power of Attorney”.

Step 2: Document Verification (Most Critical!)

Documents prepared abroad (Power of Attorney, passport/ID copies, proof of kinship, etc.) must absolutely be submitted to the Taiwan overseas mission in your country (e.g., Taipei Economic and Cultural Office in Indonesia, Vietnam, Thailand) for “Verification”. Without this, the BLI will not accept the application.

Step 3: Submit Application

Send verified documents to your trustee in Taiwan to submit to the Bureau of Labor Insurance.

IV. Special Notes (Fees & Checks)

Self-Paid Overseas Remittance Fees:

If remitting to a foreign bank account (English account info & SWIFT CODE required), you (the applicant) bear all international handling fees. The BLI deducts this directly from the benefit.

One-time: Deducted once.

Monthly Annuity: Deducted every month. Evaluate if cost-effective.

“Annual Check” for Annuity:

If receiving the “Old-Age Annuity” (monthly), you must annually provide verified identity documents to the BLI to prove you are alive. Failure to do so will suspend payments19.

No Refund Mechanism:

Labor Insurance is comprehensive insurance (covering injury, death, etc.), not a savings account. If you do not meet the “Seniority” or “Age” requirements, premiums paid cannot be refunded20.

※Disclaimer:

The above information is for reference only. Actual eligibility, application procedures, calculation of amounts, and related fees are subject to the Bureau of Labor Insurance regulations. Ministry of Labor FAQs are provided additionally.