(FWA 2025/12/24)Starting from 2026, in response to the minimum wage increase to NT$29,500, Labor Insurance, Health Insurance, and overtime pay will be adjusted simultaneously. Below are the calculation examples for each cost adjustment:

I. Health Insurance Adjustment (Example: Tier 1 NT$29,500 / Domestic Migrant Workers)

Applicable to: Industrial migrant workers receiving the minimum wage, and domestic migrant workers (family caregivers/domestic helpers).

Note: Although some domestic migrant workers are not subject to Labor Standards Act salary regulations, their Health Insurance insured amount must follow the lowest tier of the premium table.

Fee Changes:

Migrant Worker’s Share (30%): NT$458 / month (Increase of NT$15 compared to current rate).

Employer’s Share (60% + 1.56 average dependents): NT$1,428 / month (Increase of NT$44 compared to current rate).

Premium Calculation Formula:

Migrant Worker’s Share = Insured Amount × 5.17% (Rate) × 30%

Employer’s Share = Insured Amount × 5.17% (Rate) × 60% × (1+0.56)

II. Labor Insurance Adjustment: Industrial Migrant Workers (Example: Insured Salary NT$29,500)

Applicable to: Factory workers, institutional caregivers, coastal fishermen, construction workers, recycling industry workers, and other migrant workers subject to the Labor Standards Act.

Fee Amounts:

Migrant Worker’s Share: NT$679 / month

Employer’s Share: NT$2,375 / month

III. Overtime Pay Calculation Reference (Example: Monthly Salary NT$29,500)

Calculation Basis: Minimum wage NT$29,500

Average Hourly Rate: NT$123 [29,500 ÷ 30 (days) ÷ 8 (hours), unconditional round up]

Average Daily Rate: NT$984 [29,500 ÷ 30 (days), unconditional round up]

Note: This table uses “unconditional round up” for calculations.

IV. Mid-level Skilled Manpower (Mid-level Migrant Workers) Labor/Health Insurance Tiers

Mid-level skilled manpower costs are based on the “actual monthly salary” matched to the insurance tier. Reference examples:

Tier 3 (Insured Amount NT$31,800)

Applicable to: Actual salary NT$30,301 to NT$31,800 (e.g., institutional caregivers transferring with salary ≥ NT$31k).

Migrant Worker’s Share: NT$493

Employer’s Share: NT$1,539

Tier 4 (Insured Amount NT$33,300)

Applicable to: Actual salary NT$31,801 to NT$33,300 (General industrial mid-level manpower threshold is NT$33k).

Migrant Worker’s Share: NT$516

Employer’s Share: NT$1,611

Tier 6 (Insured Amount NT$36,300)

Applicable to: Actual salary NT$34,801 to NT$36,300 (e.g., industrial salary ≥ NT$35k exempt from technical certification).

Migrant Worker’s Share: NT$563

Employer’s Share: NT$1,757

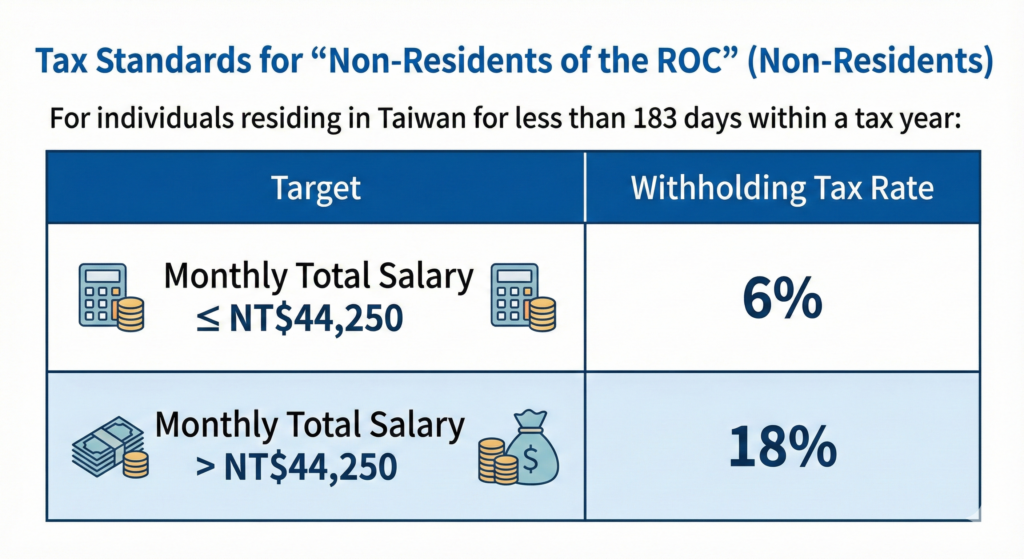

V. Tax Standards for “Non-Residents of the ROC” (Non-Residents)

For individuals residing in Taiwan for less than 183 days within a tax year (e.g., newly arrived or departing migrant workers):