(2025/08/12)

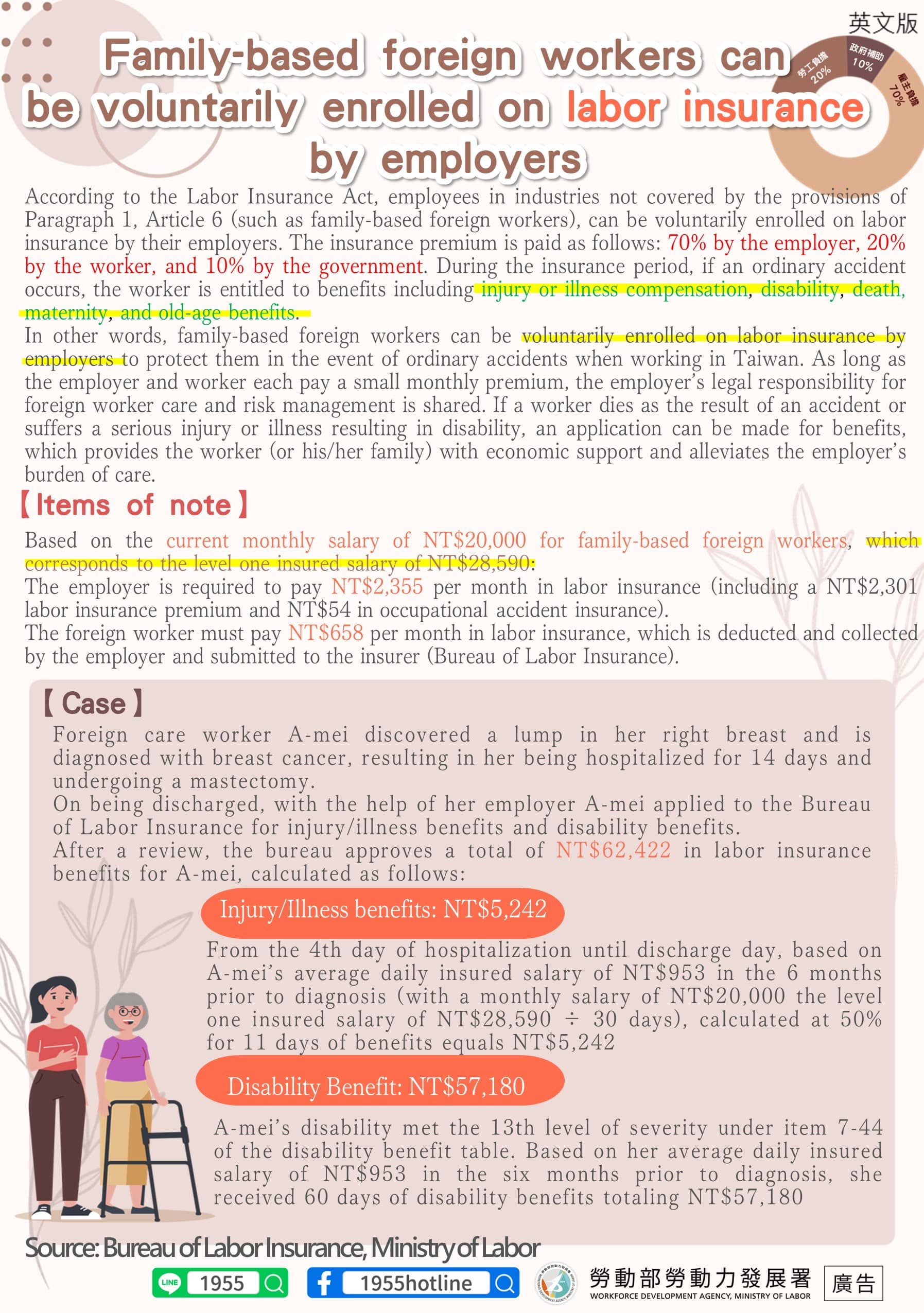

According to the Labor Insurance Act, employees in industries not covered by the provisions of Paragraph 1, Article 6 (such as family-based foreign workers), can be voluntarily enrolled on labor insurance by their employers. The insurance premium is paid as follows: 70% by the employer, 20% by the worker, and 10% by the government. During the insurance period, if an ordinary accident occurs, the worker is entitled to benefits including injury or illness compensation, disability, death, maternity, and old-age benefits.

In other words, family-based foreign workers can be voluntarily enrolled on labor insurance by employers to protect them in the event of ordinary accidents when working in Taiwan. As long as the employer and worker each pay a small monthly premium, the employer’s legal responsibility for foreign worker care and risk management is shared. If a worker dies as the result of an accident or suffers a serious injury or illness resulting in disability, an application can be made for benefits, which provides the worker (or his/her family) with economic support and alleviates the employer’s burden of care.

【Items of note】

Based on the current monthly salary of NT$20,000 for family-based foreign workers, which corresponds to the level one insured salary of NT$28,590:

The employer is required to pay NT$2,355 per month in labor insurance (including a NT$2,301 labor insurance premium and NT$54 in occupational accident insurance).

The foreign worker must pay NT$658 per month in labor insurance, which is deducted and collected by the employer and submitted to the insurer (Bureau of Labor Insurance).

【Case】

Foreign care worker A-mei discovered a lump in her right breast and is diagnosed with breast cancer, resulting in her being hospitalized for 14 days and undergoing a mastectomy.

On being discharged, with the help of her employer A-mei applied to the Bureau of Labor Insurance for injury/illness benefits and disability benefits.

After a review, the bureau approves a total of NT$62,422 in labor insurance benefits for A-mei, calculated as follows:

Injury/Illness benefits: NT$5,242

From the 4th day of hospitalization until discharge day, based on A-mei’s average daily insured salary of NT$953 in the 6 months prior to diagnosis (with a monthly salary of NT$20,000 the level one insured salary of NT$28,590 ÷ 30 days), calculated at 50% for 11 days of benefits equals NT$5,242

Disability Benefit: NT$57,180

A-mei’s disability met the 13th level of severity under item 7-44 of the disability benefit table. Based on her average daily insured salary of NT$953 in the six months prior to diagnosis, she received 60 days of disability benefits totaling NT$57,180

※If you have any further questions about working, residency, transportation, or daily life in Taiwan, the ITaiwan AI Genie is always at your service.

家事移工可由雇主申報自願參加勞保

依勞工保險條例規定,受僱於第6條第1項各款規定各業以外之員工(如家事移工),可由雇主申報自願參加勞工保險,保險費由雇主負擔70%、勞工負擔20%及政府補助10%,在保期間發生普通事故,即可享有傷病、失能、死亡、生育及老年等給付保障。

換言之,家事移工可由雇主申報自願參加勞工保險,保障其在臺工作期間之普通事故安全,只要雇主及移工每月負擔一些保費,可分散雇主依法對移工負有之照顧管理責任及風險,當移工發生意外死亡或罹患重大傷病導致失能時,均可即時申請給付,提供移工及其家屬經濟生活保障,並有效減輕雇主照顧壓力。

【注意事項】

以目前家事移工薪資每月2萬元適用第1等級投保薪資28,590元計算

雇主每月應負擔勞工保險費為2,355元(含勞保費2,301元、職災保險費54元)

移工每月應負擔勞工保險費為658元,由雇主扣、收繳後,一併向保險人(勞保局)繳納

【案例】

看護移工阿梅發現自己的右胸長了不明腫塊,經醫師診斷罹患乳癌,住院14日

接受切除右乳之手術治療。

出院後阿梅透過雇主協助,向勞保局同時申請勞保傷病給付及失能給付,

經勞保局審查核給阿梅勞保給付合計6萬2,422元,計算方式如下:

傷病給付5,242元

自阿梅住院之第4日起至出院日止,按阿梅發生事故前6個月平均日投保薪資953元(以每月2萬元薪資適用第1級平均月投保薪資28,590元除以30 )*50%*給付11日傷病給付計5,242元

失能給付57,180元

失能程度符合失能給付標準附表第7-44項第13等級,按阿梅診斷失能時前6個月平均日投保薪資953元,發給60日失能給付計57,180元