(FWA 2025/09/05)

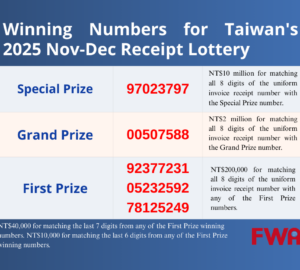

When people go shopping, they can ask the store for a uniform invoice (receipt). The receipt lottery is held in January, March, May, July, September, and November every year.

National Taxation Bureau of Taipei, Ministry of Finance said that if the receipt is in certain situations, even if it wins, the prize cannot be collected. For example, if the purchase amount is NT$0, or if the receipt is void, the prize cannot be claimed.

According to Article 11 of the Uniform Invoice Award Regulations, receipts in these cases cannot get prizes:

- The uniform invoice receipt does not indicate the amount of the sale or indicates the amount of the sale by a zero or negative.

2.The uniform invoice receipt does not indicate the amount of the sale in accordance with regulations, or the amount of the sale shown does not match the transaction, or the receipt is not stamped with the special uniform invoice chop of the issuer.

3.The uniform invoice receipt is torn, or has indistinct or illegible entries, unless the invoice issuer authenticates that entries in the receipt are consistent with those in the issuer’s copy.

4.The buyer indicated on the uniform invoice receipt has been altered.

5.The uniform invoice receipt has been marked as void.

6. The uniform invoice was issued for sales in which a zero rate of business tax applies as provided by laws.

7.The uniform invoice was issued on a daily summary basis according to the rules.

8.The uniform invoice was made up after the business entity was found to have failed to issue uniform invoices or understated the sales amount on uniform invoices.

9.The buyer shown on the uniform invoice receipt is a government agency, state-owned enterprise, public school, military unit or a business entity.

10.The winner fails to claim the prize before the prescribed deadline.

11.The winner applied for tax refund in accordance with “The Regulation Regarding the Claiming of VAT Refunds by Foreign Passengers Purchasing Goods Eligible for VAT Refund”.

For instance, if you use discount coupons and the total becomes NT$0, or if you return goods and the receipt is voided, then even if the receipt wins, you cannot get the prize. Also, if someone sells goods online without tax registration and only gets receipts for transaction fees from the platform, these receipts also cannot be used to claim prizes.

The Taxation Bureau reminds that if you cannot collect the prize, please first check the related rules. If you have questions, call the 24-hour service number 412-8282. For mobile phones, dial 02-412-8282.

※If you have any further questions about working, residency, transportation, or daily life in Taiwan, the ITaiwan AI Genie is always at your service.

注意!這些發票中獎無效

民眾購物的時候,可向有開立統一發票的店家索取統一發票,且可在每年1月、3月、5月、7月、9月、11月對獎。財政部臺北國稅局表示,若統一發票有不適用給獎情形,例如消費金額為0元、統一發票作廢,即使中獎也無法領取獎金。

根據統一發票給獎辦法第11條規定,若有下列情形之一將無法領獎:

一、無金額,或金額載明為零或負數者。

二、未依規定載明金額或金額不符或未加蓋開立發票之營利事業統一發票專用印章者。

三、破損不全或填載模糊不清、無法辨認者。但經開立發票之營利事業證明其收執聯與存根聯所記載事項確屬相符經查明無訛者,不在此限。

四、載明之買受人經塗改者。

五、已註明作廢者。

六、依各法律規定營業稅稅率為零者。

七、依規定按日彙開者。

八、漏開短開統一發票經查獲後補開者。

九、買受人為政府機關、公營事業、公立學校、部隊及營業人者。

十、逾規定領獎期限未經領取獎金者。

十一、適用外籍旅客購買特定貨物申請退還營業稅實施辦法規定申請退稅者。

舉例來說,若因使用折價券而發票金額為0元,或因購物退貨因此發票作廢,即使發票中獎也不能領獎。另外,也有民眾為貼補家用,透過網路平台銷售貨物但未辦理稅籍登記,並取得網路銷售平台開立的交易手續費發票,這些情況都無法領取中獎獎金。

國稅局表示,如民眾無法順利兌領獎金,可先確認相關規定。如有任何疑問,可撥打24小時客服專線4128282。手機撥打則為02-4128282。